Medical Insurance Articles Medical health insurance Kentucky Health Insurance Choosing Between HMOs and PPOs

Most Kentuckians are enrolled in a managed care plan. Whether you get Kentucky individual health insurance through your employer or purchase a plan on your own, you would have to consider various points before you choose between an HMO and a PPO.

Under managed care, the insurance company contracts with physicians, hospitals, and other healthcare providers that collectively form the plans network. There are basically two types of managed care plans health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Where you live or, for some plans, where you work, determine your eligibility to enroll in an HMO. There are also point-of-service (POS) plans that combine features of both HMOs and PPOs.

HMOs vs. PPOs

To choose a HMO plan and a PPO plan, you have to compare them. For this, it is necessary to understand the basic differences between these two types of plans.

Choice of healthcare providers: Managed care plans require you get most or all healthcare services from providers affiliated with the Kentucky health insurance plan. With a PPO, you can choose from preferred providers within the plans network or from out-of-network providers. If the provider is not in the network, you would have to pay more.

Primary care physician (PCP): With Kentucky individual health insurance through an HMO, you would have to choose a PCP to coordinate your healthcare. If you need to see a specialist in the network, your PCP would have to provide you with a referral. You would most likely have to pay for your healthcare if you do not have a referral or consult a doctor that is not in your HMOs network. With a PPO, you do not have to select a personal care physician. You can choose to see any doctor, though you would have to pay more if this doctor is not in the preferred network.

Specialist consults: Except in an emergency, an HMO requires you to have a referral from your PCP to see a specialist such as a surgeon or a cardiologist. No referral is needed to consult a specialist with a PPO, unless the specialist requires one.

Insurance claims: If you choose a Kentucky individual health insurance plan that is a HMO, you will have little paperwork. This means that your provider, and not you, would have to file the claim. You may not be charged or sent a bill by your provider. With a PPO plan, you may have to make the full payment to a provider for out-of-network services, and then file a claim to get reimbursed. Also, the PPO may pay only part of the bill you would have to pay the rest.

Costs: With a HMO, your out-of-pocket costs are generally limited to the low amount specified in the plans brochure. The charges would comprise that for in-network services such as copayments for doctor's visits, procedures and prescriptions. In a PPO network, you would be responsible for the copay and for the annual deductible.

Choose the Right Kentucky Health Insurance Plan

Comparing your options to make the right decision on buying a health insurance plan is easy with professional guidance. Contact an experienced licensed Kentucky health insurance agent to enjoy benefits such as free quotes from leading health insurance companies and expert advice to choose a plan.

Article By: Tracy McManamon

Social Security Disability Insurance Steps to Ensure the Right Application Process

Continuing Healthcare Checklist

Tips to find a Savvy Insurance Agent in Colorado

Understanding Your Ohio Health Insurance Coverage

Patio Umbrella - Beat the heat with Cool Patio umbrellas

How does insurance eligibility verification helps in reducing denials and the medical billing cycle

Improving Patient Collections Medical Billing

Medical Insurance - Health Insurance Coverage & Plans Explained

The Top Five Health Insurance Plans

Cheap Health Insurance Plan - A Simple Way to Save Money

How to Find Affordable Health Insurance

Health Insurance Options & Free Clinics

How Many Homeowner Insurance Quotes Do I Need To Save Money?

Where To Find Cheap Health Insurance

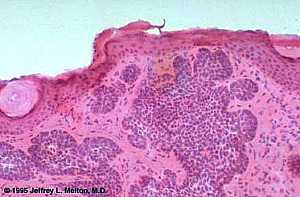

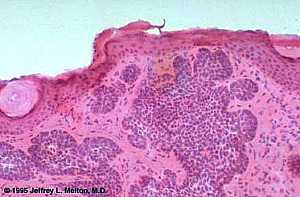

Basal Cell Carcinoma ("Rodent Ulcer" Type)

Basal Cell Carcinoma ("Rodent Ulcer" Type)

Basal Cell Carcinoma (Histology-Morpheaform Type)

Basal Cell Carcinoma (Histology-Morpheaform Type)

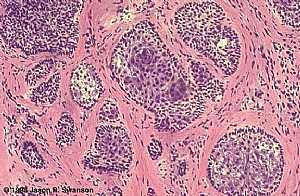

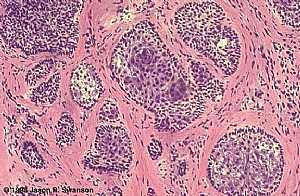

Basal Cell Carcinoma (Histology-Nodular Type - High power)

Basal Cell Carcinoma (Histology-Nodular Type - High power)

Basal Cell Carcinoma (Histology-Nodular Type- High power)

Basal Cell Carcinoma (Histology-Nodular Type- High power)

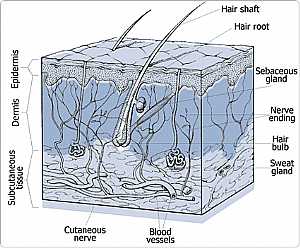

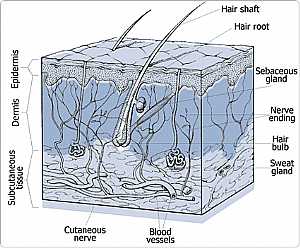

Skin

Skin

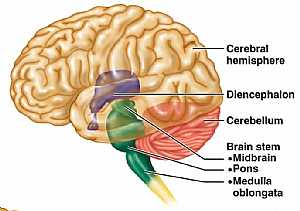

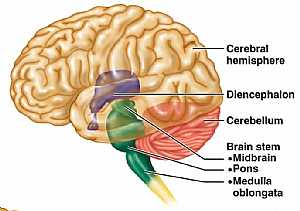

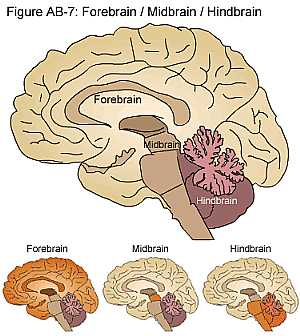

Nervous System -- Basic

Nervous System -- Basic

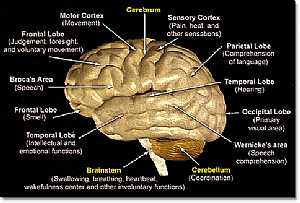

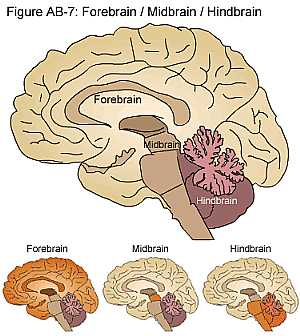

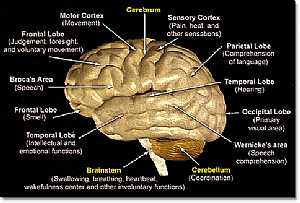

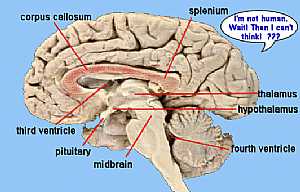

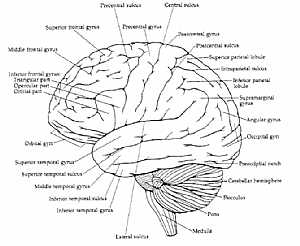

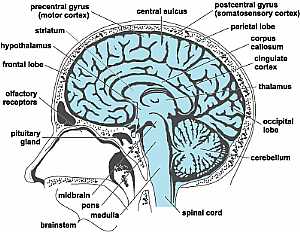

Brain anatomy

Brain anatomy

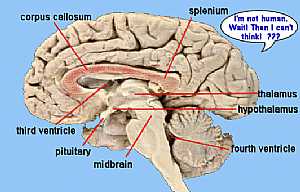

Brain anatomy

Brain anatomy

Brain anatomy

Brain anatomy

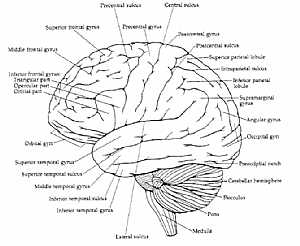

Brain anatomy

Brain anatomy

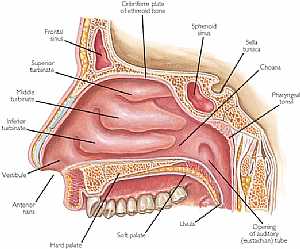

Head anatomy

Head anatomy

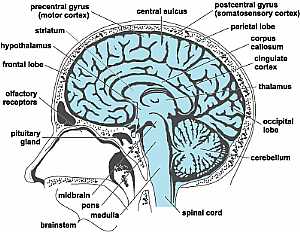

Brain anatomy

Brain anatomy

© Copyright 2001-2022 eDoctorOnline.com

Nose anatomy

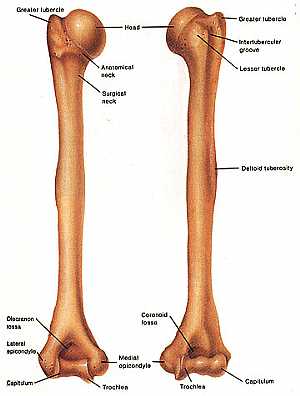

Nose anatomy Humerus bone

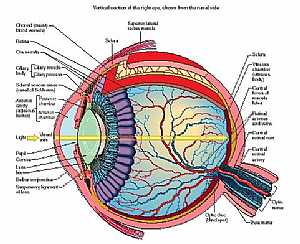

Humerus bone Eye anatomy

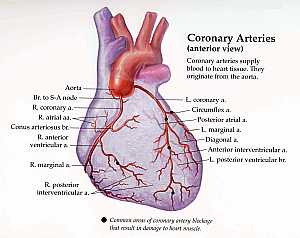

Eye anatomy Coronary arteries anatomy

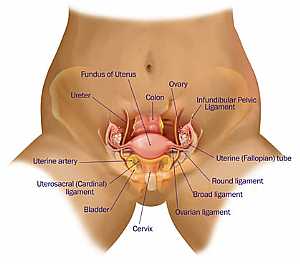

Coronary arteries anatomy Female pelvic anatomy

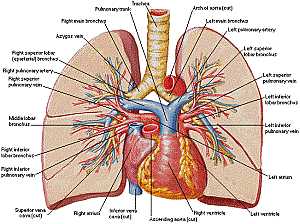

Female pelvic anatomy Heart and lung anatomy

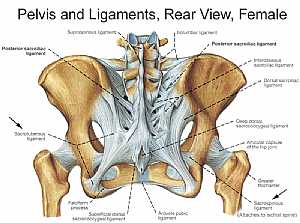

Heart and lung anatomy Bones and ligaments of the FEMALE Pelvis

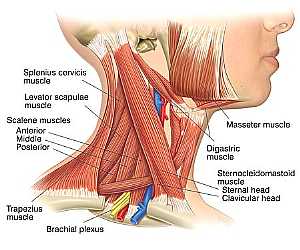

Bones and ligaments of the FEMALE Pelvis Neck Anatomy

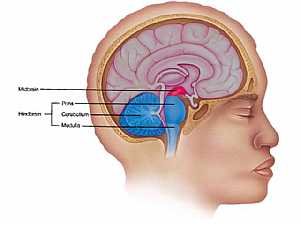

Neck Anatomy MidBrain anatomy

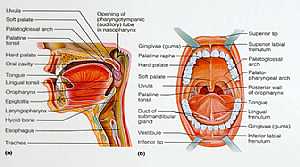

MidBrain anatomy Oral Cavity

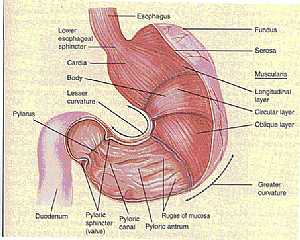

Oral Cavity Stomach anatomy

Stomach anatomy Lung anatomy

Lung anatomy Basal Cell Carcinoma ("Rodent Ulcer" Type)

Basal Cell Carcinoma ("Rodent Ulcer" Type) Basal Cell Carcinoma (Histology-Morpheaform Type)

Basal Cell Carcinoma (Histology-Morpheaform Type) Basal Cell Carcinoma (Histology-Nodular Type - High power)

Basal Cell Carcinoma (Histology-Nodular Type - High power) Basal Cell Carcinoma (Histology-Nodular Type- High power)

Basal Cell Carcinoma (Histology-Nodular Type- High power) Skin

Skin Nervous System -- Basic

Nervous System -- Basic Brain anatomy

Brain anatomy Brain anatomy

Brain anatomy Brain anatomy

Brain anatomy Brain anatomy

Brain anatomy Head anatomy

Head anatomy Brain anatomy

Brain anatomy

Be the first one to comment on this article!